Chubb’s Mike Williams sheds light on risk and insurance considerations manufacturers should keep in mind when nearshoring or reshoring.

by Mike Williams, Executive Vice President, North American Manufacturing Industry Practice Leader, Chubb

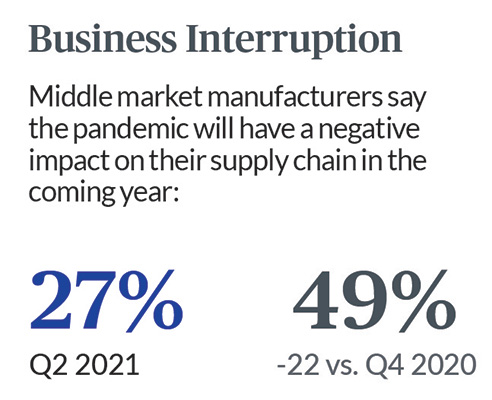

Over the past year and a half, manufacturers have been contending with a variety of business challenges. Facility shut-downs, port delays, weather-related events, geopolitical factors, and other disruptors have caused many to reevaluate their supply chains. According to data from Chubb and the National Center for the Middle Market (NCMM), some middle market manufacturers remain concerned about the long-term consequences of COVID-19 in particular, with more than a quarter (27%) indicating they believe the pandemic will have a negative impact on their supply chains in the coming year.

As a result, many manufacturers are reassessing their supply chain needs. For some, this includes considering nearshoring (moving outsourced operations closer) or reshoring (returning outsourced operations to their home country). While nearshoring and reshoring can deliver certain benefits, such practices cannot prevent all potential disruptions. Manufacturers should evaluate how these approaches may change their risk profiles, so they can implement the necessary risk mitigation strategies and secure the right insurance coverages and limits for their unique and evolving needs. From understanding the geopolitics of their business environment to assessing how internal and external factors may impact exposures, following are a few key considerations manufacturers should keep in mind when considering nearshoring or reshoring operations.

No matter where manufacturers operate, it’s critical to consider the geopolitical environment and other regional nuances.

For example, U.S. tariffs on goods imported from China may prompt some manufacturers to consider nearshoring. But when doing so, manufacturers should assess other factors including, but not limited to:

Manufacturers should consider creating redundancy in their supply chains to help minimize such risks and potential interruptions. To this end, identifying alternative suppliers can help manufacturers stay on track with production if their primary supplier is unable to deliver the agreed upon quantity or quality of source material on time. Manufacturers also should strive to structure their supply chains in a way that enables them to ship products from multiple regions, potentially lessening the impact on the bottom line if there is disruption in a particular area.

Manufacturers that are nearshoring or reshoring also need to assess potential risks related to their internal operations, such as how materials are stored.

To illustrate this point, consider the following: manufacturers may be able to store a higher volume of certain materials abroad than in the U.S. due to differing fire hazard regulations. While this may be addressed—for example, by installing an enhanced fire sprinkler system or securing additional storage space, depending on the material, location and specific regulations—other internal factors can be more complex. Manufacturers reshoring operations involving certain toxic materials, for instance, may significantly increase pollution-related exposures at the facility to which they are moving. As a result, manufacturers may want to continue to subcontract more hazardous operations to third parties, and reshore other parts of their business.

External factors such as natural disasters and theft also merit consideration when reshoring or nearshoring operations.

When relocating to a natural disaster-prone area, manufacturers should ensure that they are as protected as possible from weather-related business interruption. There are certain tactics manufacturers can implement to help reduce risk, ranging from fire-resistant materials when building facilities near wildfire zones to making sure roofs are properly secured and backup generators are in working order in hurricane prone areas.

Additionally, when it comes to theft prevention, manufacturers should consider not only their own protective measures, but also those of the transportation companies they plan to use. It may benefit manufacturers to contract with transportation companies that leverage GPS trackers and other security practices, so they can have peace of mind knowing their goods are protected while in transit.

Whether reshoring or nearshoring, manufacturers must carefully consider how their exposures may change as their supply chains evolve.

Manufacturers should work with their insurance agent or broker to secure the insurance coverages needed to help them stay protected and eliminate potential coverage gaps. These coverages may include, but are not limited to:

As manufacturers nearshore and reshore operations, potential risk implications must be at the forefront of the conversation. By working together with their insurance agent or broker, as well as their insurer, manufacturers can adjust their insurance programs as risks evolve so they’re better protected and better prepared to anticipate the challenges to come.

This document is advisory in nature and is intended to be a resource to be used together with your professional insurance advisors in maintaining a loss prevention program. It is an overview only, and is not intended as a substitute for consultation with your insurance broker, or for legal, engineering or other professional advice.

About the Author:

Mike Williams is responsible for growth and profit of the Manufacturing segment within North America.

He originally joined Chubb in 1989 in Seattle as a commercial underwriter. In the years since, Mike relocated four times in the western U.S. and assumed increasing levels of leadership responsibility, including opening and running Chubb’s second production office (Fresno, CA) and managing commercial lines in Denver and Northern California. In 2013, Mike assumed the role of Executive Field Underwriter for the West and Southwest regions. From 2016 to 2018 Mike ran commercial underwriting in the Western U.S. for a competitor, returning to Chubb in 2018 to assume his current role.

Mike holds a bachelor’s degree in Business Administration from Washington State University.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.