The POWWR Winter Outlook warns that La Nina conditions may be arriving later than expected, resulting in a weaker than expected La Nina.

By Ian Palao, VP, Strategic Energy Services at POWWR

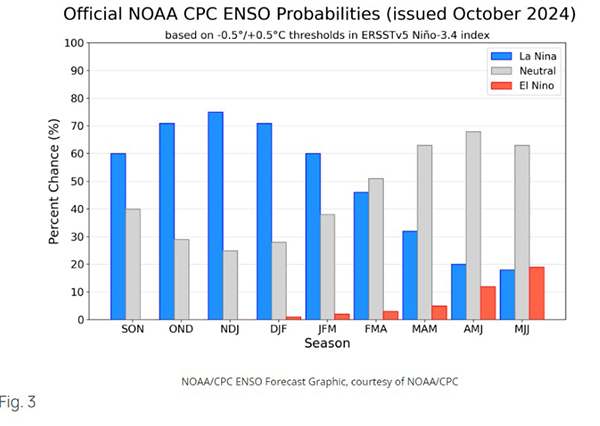

For winter, the state of the El Nino -Southern Oscillation (ENSO) is paramount to getting a handle on what winter could become. This is the single, most important ocean-atmosphere teleconnection that climatologists and meteorologists use to narrow down the outcome of seasonal weather in an almost infinite array of possibilities. While we are currently in an “ENSO Neutral – La Nina Watch” status, climate models are almost unanimously in favor of La Nina conditions developing in the coming months. NOAA’s Climate Prediction Center reports that “La Niña is favored to emerge in September-November (71% chance) and is expected to persist through January-March 2025.” Personally, I thought that the Nina would have been stronger at this point. Given that it is not, there is a good chance that this Nina may be weak. If so, the “typical” Nina temperature anomalies may not be representative of Winter 2024-25.

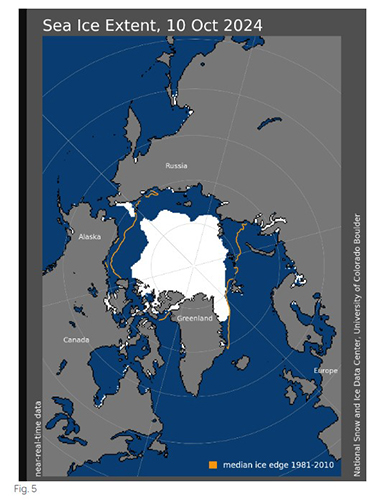

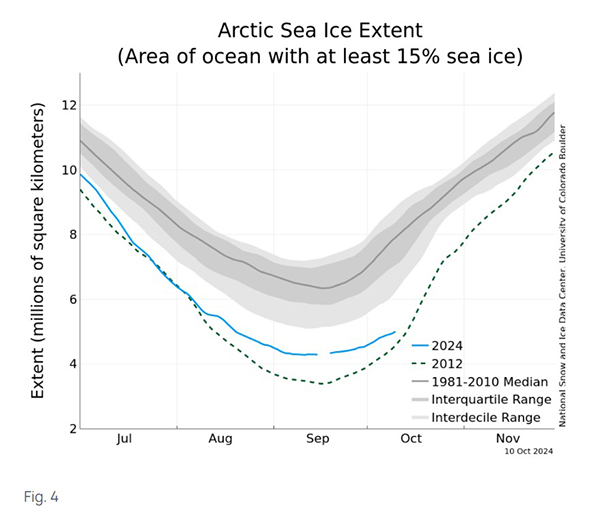

Arctic sea ice typically reaches a minimum in mid-September. This year is no different. In the Fall, as daylight becomes less and less, Arctic temperatures get colder and sea ice reforms. The pace of sea ice retreat this summer has been very close to the long-term (1981-2010) rate of retreat. As we have recently begun the sea ice building process and there is less sea ice from which to build on, there is far less areal coverage than the long-term average.

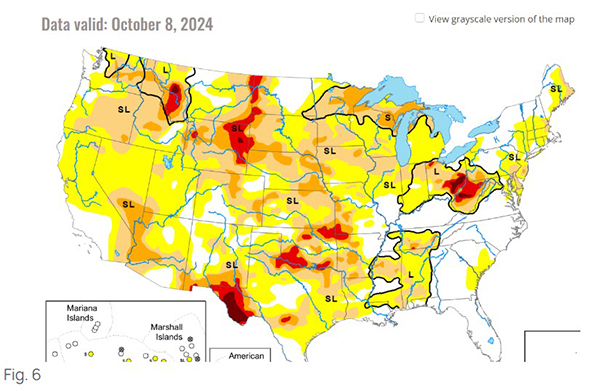

Soil moisture is a very short-term index and can rapidly change. Its impacts on winter temperatures are subtle. Drier conditions can lead to enhanced cooling while wetter conditions lead to some slight warming modification of the cold air mass. If we look at current soil moisture conditions across the continental US, it is readily apparent that soil moisture is lacking to some extent in a majority of the country. Only the Southeast stands out as having normal moisture, as a result of the recent hurricanes.

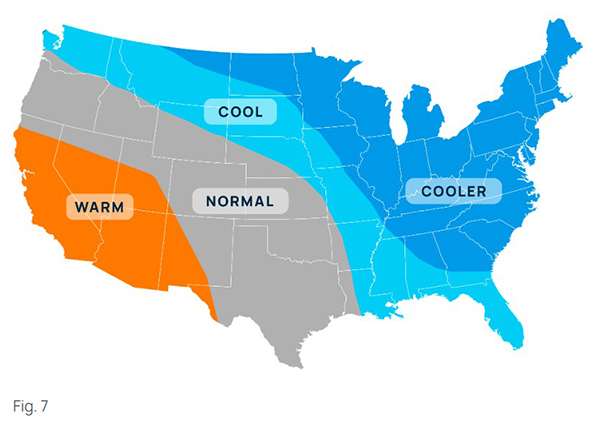

We are calling for generally cold conditions from November through March (in aggregate) east of the Mississippi River. We believe the avenue the cold air will take will be Great Lakes centered, leading to a cold Ohio Valley, Mid Atlantic, New England, and Southeast. The Plains, western Midwest, and Texas falls out of the aggregate cold category, in favor of normal. Warm conditions are confined to the Southwest. Of course, this does not mean that areas identified as “normal” or “warm” will not experience some stretches of cold (or even brutal cold) if the avenue of entry shifts for any particular arctic blast event or events.

We want to take a moment and speak to the risks to our winter outlook. We believe these risks are two-fold. The first risk is an anomalously warm look east of the Rockies. We do not think this is likely as this outcome is more representative of a typical La Nina and in early November a La Nina is still yet to be declared. Officially, we are in “neutral” conditions with a “La Nina Watch”. The watch means that La Nina is expected. For argument’s sake, even if La Nina is declared in mid-December, because both La Nina and El Nino are oceanic phenomena, it will take a month to a month and a half for the oceanic influence to transfer into the atmospheric process (specifically the jet stream flow). This time lag reflects the time for the oceanic-atmospheric teleconnection to occur. If the December La Nina does occur, we are looking at a Nina that will only influence February and early March to an extent, at best. This is generally not a long enough time frame to impact the entirety of winter, in aggregate.

The second risk to our official outlook, and one that we think is more reasonable, is very cold conditions in the center of the country, as opposed to the east. Given that we believe the La Nina will be “weak” if it does in fact occur, or perhaps does not officially occur and “neutral” conditions persist into the first quarter of 2025, then cold conditions are then increasingly likely. The question at that point is where the entry point of the Arctic air that could flow from Canada into the US sets up and if that location persists through the entire winter. There have been both neutral conditions and Nina conditions where cold anomalies are in the midsection of the US as the entry point for the cold is down the backside of the Rocky Mountains and into the Plains. It is for that reason that we do believe this to be the most likely risk.

Ian Palao specializes in commodity risk management and the science of meteorology/climatology. He serves as one of POWWR’s many subject matter experts. He has 20 years of experience in the energy/utility industry, where he used his skills and knowledge of meteorology and advanced statistics.

From 2000 through 2011, he worked at TXU Energy Trading/Luminant Energy in Dallas where he served in three capacities. Most recently, he served as Capital/Liquidity Manager of the trading portfolio, optimizing the use of capital while still maintaining profitability. Prior to that, he managed the Weather Derivatives trading desk, devising strategies and executing trades for both speculative and hedging purposes. Upon joining TXU, he served as manager of the Quantitative Risk Group, assisting the company in the identification, quantification, and remediation of financial risks inherent in the company’s multi-commodity trading portfolio.

In his first foray into energy/utilities, he was a Marketing Executive with Louisiana Gas Service Company, a local distribution company, where he primarily marketed natural gas technology to commercial and industrial customers. Before that, he served as a Research Scientist under contract to the National Oceanic and Atmospheric Administration (NOAA).

Palao has an M.B.A. from Tulane University. He also has both an MS and BS in Meteorology from Florida State University. He is a member of the Financial Weather and Climate Risk Management Committee of the American Meteorological Society (AMS).

A warm welcome to our guest Didi Caldwell, CEO of Global Location Strategies (GLS) and one of the world’s top site selection experts. With over $44 billion in projects across 30+countries, Didi is reshaping how companies choose where to grow. Here she shares insights on reshoring, data-driven strategy, and navigating global industry shifts.