March 1, 2018

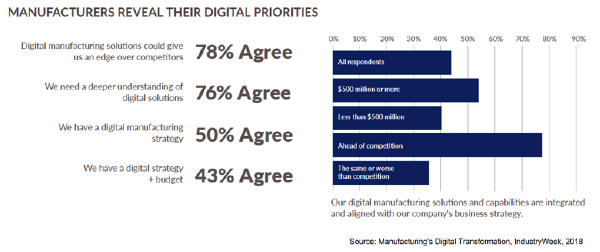

Industry analysts including McKinsey & Company [1] and the World Economic Forum [3] have documented the current undisputable momentum building up in industries including manufacturing towards a new digital enterprise reality. Has your organization embraced this enterprise digital transformation? Figure 1 shows the results from a recent survey by Industry Week [4] and it reveals that indeed most surveyed manufacturers have intent to move forward with a Digital Manufacturing initiative. However, when asked about the roadmap and timing of these efforts, manufacturers have significantly less enthusiastic answers.

Figure 1. Manufacturers reveal their digital priorities

Manufacturers are often held back by the lack of a concrete roadmap, the perception of security risks, and the overwhelming number of approaches and technologies being talked about under the heading of Digital Manufacturing. Given the confusing landscape, is it better to wait a little and wait for early adopters to incur the cost of experimentation with the first wave of adoption of these new processes and technologies?

This is a strategic question that each organization should ask itself—very soon; because the clock is ticking, and surveys indicate that competitors are moving forward. Each organization should evaluate the disruptive potential of Digital Manufacturing in their corner of the market. The executive team should strategically discuss questions like these:

As the intensity of global competitors developing new products, services and ecosystems raises the stakes, the pressure is on manufacturers to think differently about business models; cultivating additional revenue streams and finding novel ways to outflank the competition. The Digital Manufacturing strategy isn’t just about incremental change or cost of savings, it’s about innovating and incorporating innovation at a much higher pace than ever before.

Continuous improvement strategies that depend on Kaizen events and small incremental changes might have worked for organizations in the past few decades but may not work now to achieve the transformation required for Digital Manufacturing. At least not without a planned roadmap leading to a future state that establishes the required systems infrastructure to connect the enterprise and enable the business to participate in new manufacturing ecosystems with OEMs and peer suppliers.

The Digital Manufacturing revolution is expected to disrupt markets and change the competitive landscape. Methods of measuring market share might require update and the organization might not detect market changes until it is too late. It is natural to maintain defensive focus against the same usual competitors while new ones might go unnoticed. New market entrants with innovative products and service offerings can start to take revenue away from the traditional market before the organization and industry analysts notice the changes. By then, the organization could have lost key contracts and lost market position.

History shows that companies leading disruption of markets enjoy an ongoing advantage in those markets for many years. Especially when the resulting market lowers costs and pricing for end customers. Competitors that implement Digital Manufacturing sooner can drive prices down due to their increased levels of efficiency and productivity. Your organization might be left with lower profit margins and less money to invest on catching up and implementing the required technology to quickly join the redefined market ecosystem. Will your old customer see you as a legacy supplier or see you as a supplier that is innovative and evolving with the market?

A big part of the intent fueling the Digital Manufacturing revolution is the desire to create ecosystems tying multi-tier suppliers into new value chains that efficiently deliver products with high customer configurability, products with high traceability of components, and products sold as services to end customers—products that go beyond the physical unit with a digital footprint that travels along with the product during its lifecycle. If your organization is not ready to join these ecosystems as they are forming, it could be harder to join them later. Especially if competitors that join early establish a good reputation. New ecosystems will not want to introduce risk into processes and supply chains that are working. Opportunities might be limited to filling in gaps and replacing unreliable suppliers. Quality, reliability, speed, and the ability to participate in the chain of required data exchanges will be more critical than pricing to join new ecosystems focused on offering premium customer service. Your organization could soon be facing new ways of conducting business with old customers.

It is already difficult to acquire the required new talent into manufacturing companies. The manufacturing skills gap is well documented. [5] [6] A latecomer to Digital Manufacturing might find it even harder to find talented resources if the best resources were hired into the early adopters as job seekers perceived them to be the innovative leaders and better workplace choices.

Creating a new division or acquiring a newer company are valid paths into Digital Manufacturing, but they are not the only paths. Organizations can evolve their practices with different approaches including piloting new techniques at new green-field programs and implementing technology that makes it practical to bridge older equipment at brown-field sites into newer Information Technology (IT) infrastructures and processes. When organizations implement digital transformation, they are not just enabling new business models, they are also making the old models work more efficiently by improving visibility, control, velocity, and customer service. These type of systems and process enhancements strengthen relations with existing customers and puts the organization in a better position to tackle new initiatives knowing there is a reliable revenue stream from an existing customer base.

Departmental managers around your organization will continue to do process improvement projects and some will entail the development of apps to tackle specific problems within their area of responsibility. After all, it is easy these days for non-IT personnel to develop apps and deploy them on their own smart phones. Shadow IT is a symptom of an organization that is not updating IT systems and infrastructure fast enough to keep up with the internal needs for process improvement.

However, shadow IT efforts can create more problems than they solve and will not get the organization to the required Digital Manufacturing platform. There needs to be a plan in place orchestrated by the IT department providing guidance and governance on security, data models, standardized enterprise systems, and data exchange practices. Otherwise, we can end up with a mishmash of tools and apps that don’t play well together, need to be updated separately, and cannot be efficiently sustained in the long term. Shadow IT is not a game you want to play in the high stakes arena of Digital Manufacturing. Even if the use of apps continues to be prevalent in the Digital Manufacturing landscape, the IT department should be empowered to architect them as part of an integrated enterprise systems landscape. The longer the organization waits to institutionalize Digital Manufacturing, the bigger the effort will be to move departments off their custom independent solutions and into enterprise integrated processes.

Organizations should move forward without delay, define their end-state strategic goals, and their roadmap with progressive milestones toward their Digital Manufacturing vision. To advance the initiative effectively, it is important to get specific about the organization’s digital transformation roadmap.

The industry is going through an exciting revolution and these are great times to be working in manufacturing. Companies with highly connected and adaptable systems will have a big advantage in future markets.

Conrad Leiva is the VP Product Strategy and Alliances at iBASEt, a leading provider of software solutions to complex, highly regulated industries.

Conrad Leiva is the VP Product Strategy and Alliances at iBASEt, a leading provider of software solutions to complex, highly regulated industries.

Conrad’s career has included consulting with many Aerospace & Defense companies on how to streamline the paperwork and information flow among Planning, Inventory, Quality, Production and Supply Chain disciplines. Conrad’s experience includes both manufacturing and MRO projects with companies including ARINC, ATK, Boeing, DRS, Lockheed Martin, General Dynamics, Gulfstream, Parker Hannifin, Pratt & Whitney, and Navy Shipyards. Recently, Conrad focused his work on manufacturing intelligence and the integration between engineering, business, and manufacturing systems working with PLM and ERP partners. Conrad holds an M.S. in Industrial Engineering from Georgia Institute of Technology, certifications in MES/MOM manufacturing operations management methodologies and is a certified quality auditor. Conrad is also a board member and chair of the Smart Manufacturing Group at MESA (Manufacturing Enterprise Systems Association) and periodically posts on his Manufacturing Operations Management blog.

References

[1] “Digital manufacturing: The Revolution will be Virtualized”, Hartmann, King, Narayanan ; McKinsey & Company; 2018

[2] “Why Digital Strategies Fail”, Bughin, Catlin, Hirt, Willmott; McKinsey & Company; 2018

[3] “Digital Transformation of Industries”, World Economic Forum and Accenture; 2016

[4] “Manufacturing’s Digital Transformation: Is Your Company Leading the Way or Falling Behind?”, IndustryWeek, 2018

[5] “The Skills Gap in US Manufacturing 2015 and Beyond”, Deloitte, Manufacturing Institute, 2015

[6] “Out of Inventory: Skills shortage threatens growth for U.S. Manufacturing”, Accenture, The Manufacturing Institute, 2014

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.