October 30, 2018

By Charles Maniace, director of regulatory analysis, Sovos

For the last 50 years, a series of Supreme Court cases constrained the sales tax compliance obligations of manufacturers and other organizations. These cases established that states could only compel companies to collect and remit sales tax if those businesses were physically present (meaning they had employees or property) in the jurisdiction. But the Internet knows no physical boundaries, and as technology upended traditional commerce channels and opened new avenues to profit, states began to chafe against a standard they increasingly viewed as antiquated and unfair.

Years of legislative and regulatory efforts nibbling at the fringes of this rigid doctrine turned into an all-out attack when, in 2016, South Dakota enacted a law that based sales tax on the economic connection of a seller — gross revenue from in-state sales of $100,000 or 200 or more separate transactions. Legal challenges ensued, and the case made it to the Supreme Court. In a 5-to-4 decision handed down on June 21, 2018, the court held previous cases were wrongly decided, and said states were free to compel collection standards based on economic connection, as long as those requirements don’t represent an “undue burden.”

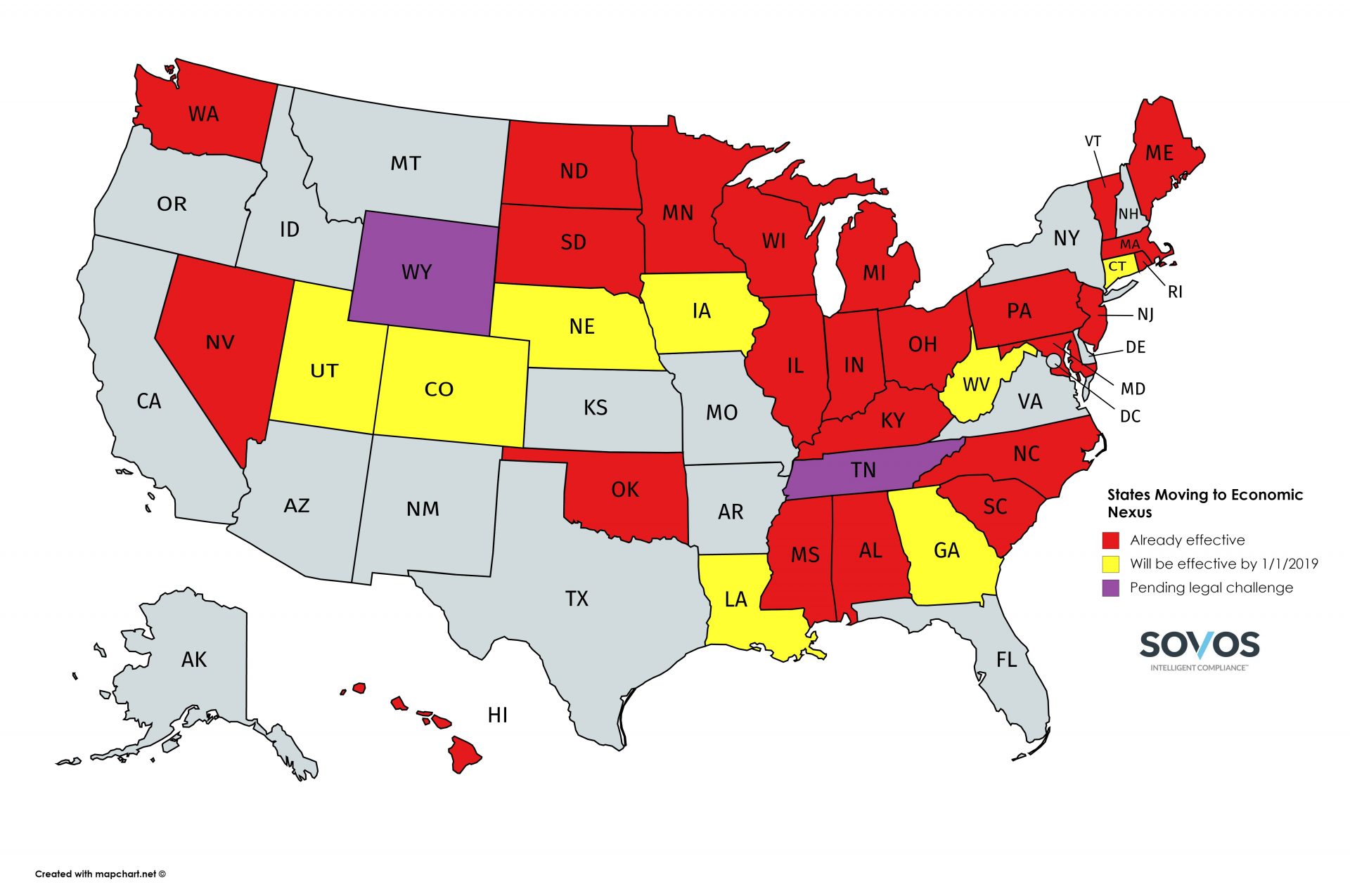

State governments, normally known for their deliberate and measured approach to rulemaking, acted with alacrity. Over the last five months, no fewer than 30 states have enacted or are enforcing collection requirements based on economic presence. All of these regulations are either already effective or will become so on or before January 1, 2019. So, what does this all mean for manufacturers?

Of the 30 states that now (or soon will) impose tax collection requirements based on economic presence, many have opted to follow the South Dakota standard of $100,000 in gross revenue or 200 separate transactions. However, states are not consistent in how they count revenue and sales. For example:

As an immediate first step, manufacturers should evaluate those states where they make the most sales to determine if they have or will have a new sales tax collection requirement. This is especially true for multi-channel manufacturers that sell directly to consumers, as a relatively small volume of sales into a state — even exempt sales — may create a new filing obligation.

Manufacturers also need to consider exemption certificate management. Even before the Wayfair decision, manufacturers considered certificate management a time-consuming and costly challenge according to a 2017 Aberdeen Group study. In this new world, inefficiencies are bound to be exposed. The burden of proving an exempt sale sits with the seller, and if you don’t have or can’t provide a properly executed certificate, you could face an audit. If your process involves paper and spreadsheets, consider whether it will withstand a vastly expanded sales tax compliance footprint.

In a recent Americas’ SAP Users’ Group (ASUG) survey of tax, finance, IT and procurement professionals, 52 percent of participants indicated they “don’t know” or were “not sure” of the percentage of invoices they had with errors related to sales and use tax treatment on purchases.

Manufacturers should already be evaluating their vendor invoices to determine if the appropriate tax is being charged. Most every state has enacted some form of exemption directed at manufacturing activities, but no state takes exactly the same approach. For example, an exemption may or may not apply based on the nature of the facility, the nature of the item, the proportion the item is used in manufacturing versus other activities, and where in the process it’s used. It’s undoubtedly already challenging for your local suppliers to know the rules.

As states move quickly to enact economic nexus standards, even more suppliers will take at least some steps to collect taxes. However, the business reality is manufacturers cannot count on these sellers to get the tax right. Nothing about the Wayfair decision changes the fact that sales tax liability is “joint and several,” which means underpaying tax to your vendors exposes your company to audit risk, and overpaying tax burns through cash you could otherwise use to grow your business.

In its decision, the Supreme Court noted affordable software exists that makes the sales tax compliance burden manageable. It seems likely that the ready availability of compliance software provided the court some assurance that eliminating the bright-line physical presence standard would not throw commerce into chaos.

In order to continue growing, manufacturers must remove the burdens caused by Wayfair’s latest sales and use tax compliance requirements, starting with three key steps. First, look at centralizing your sales and use tax departments, and review your processes and procedures around sales and use tax determination and filing. Second, ensure you have the processes and tools in place to help automate review of your vendors’ invoices for incorrect sales and use taxes. And lastly, as the collection, validation and maintenance of exemption certificate documentation may significantly expand, consider cloud-based options to reduce future risks associated with auditors’ scrutiny.

Charles Maniace is director of regulatory analysis at Sovos, a leading global provider of software that safeguards businesses from the burden and risk of modern tax. An attorney by trade, Chuck leads a team of attorneys and tax professionals responsible for all the tax and regulatory content that keeps Sovos customers continually complaint. Over his 15 year career in tax and regulatory automation, Chuck has provided analysis to WSJ, NBC and more.

Charles Maniace is director of regulatory analysis at Sovos, a leading global provider of software that safeguards businesses from the burden and risk of modern tax. An attorney by trade, Chuck leads a team of attorneys and tax professionals responsible for all the tax and regulatory content that keeps Sovos customers continually complaint. Over his 15 year career in tax and regulatory automation, Chuck has provided analysis to WSJ, NBC and more.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.