July 22, 2019

Given the choice, most of us would rather browse Instagram or log in to XBox than put together specs for our employer’s next big equipment purchase. In part, that’s because consumer-facing brands consistently deliver engaging, visually immersive experiences, whereas manufacturers and other B2B brands do not.

That absence will soon be a liability: every B2B buyer or purchaser of manufactured goods is also a consumer, meaning they’ve come to expect more from the digital content.

For example, a recent Forrester study found that more than half of B2B buyers believe they can create vendor lists and product criteria exclusively from online assets. And by 2023, ecommerce will total $1.8 trillion in the B2B space.

Translation: manufacturers can no longer afford to have anything but the highest-quality online content. When so many decision makers are relying exclusively on digital assets, manufacturers must make sure these assets can do the heavy lifting that was once the purview of sales reps.

Luckily, visualization technology on the market today makes creating that kind of content faster, easier, and far less expensive than it’s ever been. Here’s a look at how this new reality is likely to affect manufacturers.

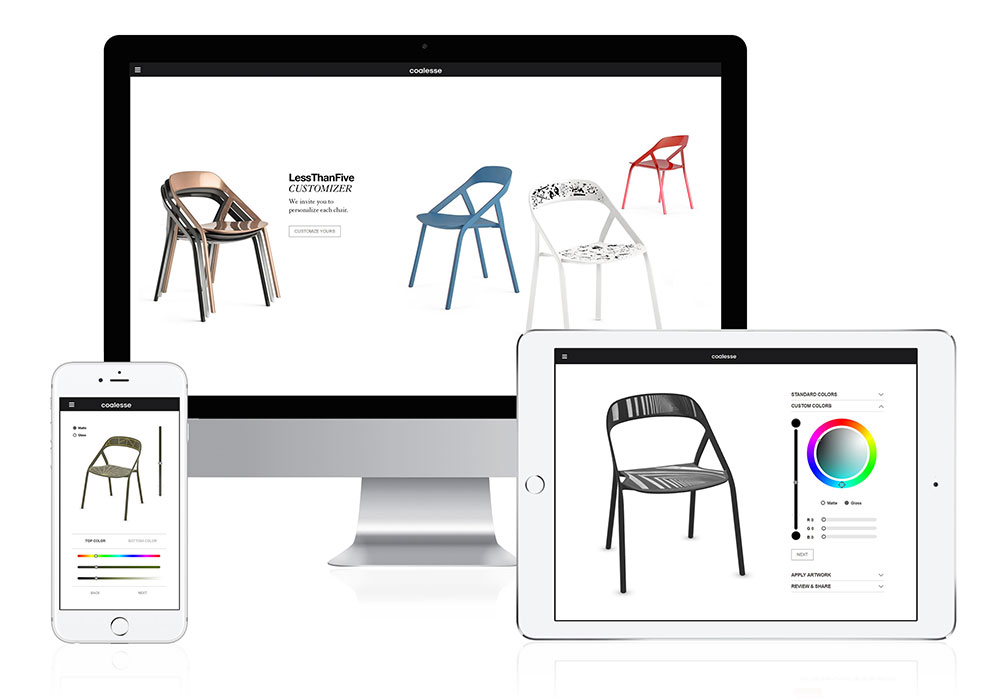

The customer has the option to customize the product with various features.

More B2B buyers leaning on digital assets means a greater potential for manufacturers to experience the problems associated with online buying in B2C, including shopping cart abandonment, high returns, and lowered trust.

To prevent those costly problems from eating into the bottom line, manufacturers can deploy visualization software.

One option is to give online buyers the chance to engage with a product via interactive 3D. With this technology, shoppers can manipulate a product to see it from all angles. They can customize it with various features, view the inside and, with the help of 3D animation, see a product “explosion” that reveals component layers. (Here’s an example that my company, ThreeKit, did to show the protective layers of a football helmet.)

This engagement creates the sense of intimacy that B2C buyers experience in real-life settings – and that B2B buyers sometimes never experience. It also increases their confidence that they’re about to order the correct part or the right model. That confidence can boost conversions by 40 percent or more and reduce returns by 80 percent.

Crucially, creating these interactive representations doesn’t require manufacturers to have 3D designers on staff. Visualization software can generate such assets from uploaded CAD files, which means the process is faster and less expensive than it’s ever been.

AR applications offer other compelling opportunities: with technology akin to what made Pokéman Go so popular a few years ago, buyers can use their phones to visualize products in their actual real-life context. While AR may have more direct applications for retailers than manufacturers, its increasing availability has the potential to impact retailers’ expectations for their manufacturer partners.

In addition to improving website sales for manufacturers directly, 3D and AR are likely to change the way retailers expect to order everything from fabric to entire lines of merchandise.

To understand why, it’s important to know that the CAD files used to make interactive 3D can also be used to create hyper-realistic and infinitely configurable two-dimensional images.

Consider, for example, a furniture retailer using this technology: sofa shoppers can click through fabric swatches, change leg type, and swap out features with the click of a mouse until they have an image of the exact couch they want.

Then, using AR, they can determine how that couch might look in their living room. If it’s a match, they can click “buy” – at which point, the retailer submits the request for this sofa to the manufacturer.

As this type of highly customized ordering becomes the norm, retailers aren’t going to want to maintain stockrooms full of generic models that may or may not appeal to their customers. Instead, they’re likely to push for just-in-time supply chains, which means manufacturers will have to have the technology and processes in place to adapt.

The technology noticeably absent from this discussion is VR, which was not long ago heralded as the future of – well, almost everything.

In fact, VR has not shown to drive much value for commerce, largely because of its difficult form factor: people don’t carry around VR headsets, and a compelling experience requires an entire dedicated room.

The surprise bright spot for VR, as many manufacturers already know, is in industrial training applications. So while VR may have shifted the way new employees learn in manufacturing workplaces, it’s unlikely to create impactful shifts in the commerce landscape in the ways 3D and AR already are.

As retailers make ever more configured, customized, and personalized products and experiences available to customers, manufacturers will feel a shift in demand from their clients. Business buyers, accustomed to their experiences as consumers, will demand higher-quality web visuals and will increasingly rely on those visuals to make purchasing decisions. They will also expect ordering and shipping options that align with what they’re offering web buyers.

Manufacturers can prepare for that reality by ensuring that their visual web content communicates clearly and developing processes to accommodate on-demand ordering.

Ben Houston, ThreeKit

About the Author

Ben Houston is the CTO of ThreeKit, a software platform that helps B2B buyers explore products in 3D, Virtual Photography, Augmented Reality, and VR. ThreeKit enables an immersive experience so manufacturers can drive engagement, trust, and more sales.

Contact: bhouston@threekit.com

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.